- Published on

The Role of Chaos Theory

- Authors

- Name

- Kubera Research

- @KubeRese

The Unpredictable Dance of Chaos: How Chaos Theory Shapes Trading

When you think of chaos, you might imagine total disorder and randomness. But in the world of trading, chaos theory helps us make sense of seemingly unpredictable market movements. Let's break it down into simple terms.

What is Chaos Theory?

Imagine a butterfly flapping its wings in Brazil. You might not think it matters, but that tiny action can set off a chain of events that eventually leads to a tornado in Texas. That's chaos theory in action. It's about how small changes in one part of a system can cause big changes in another part.

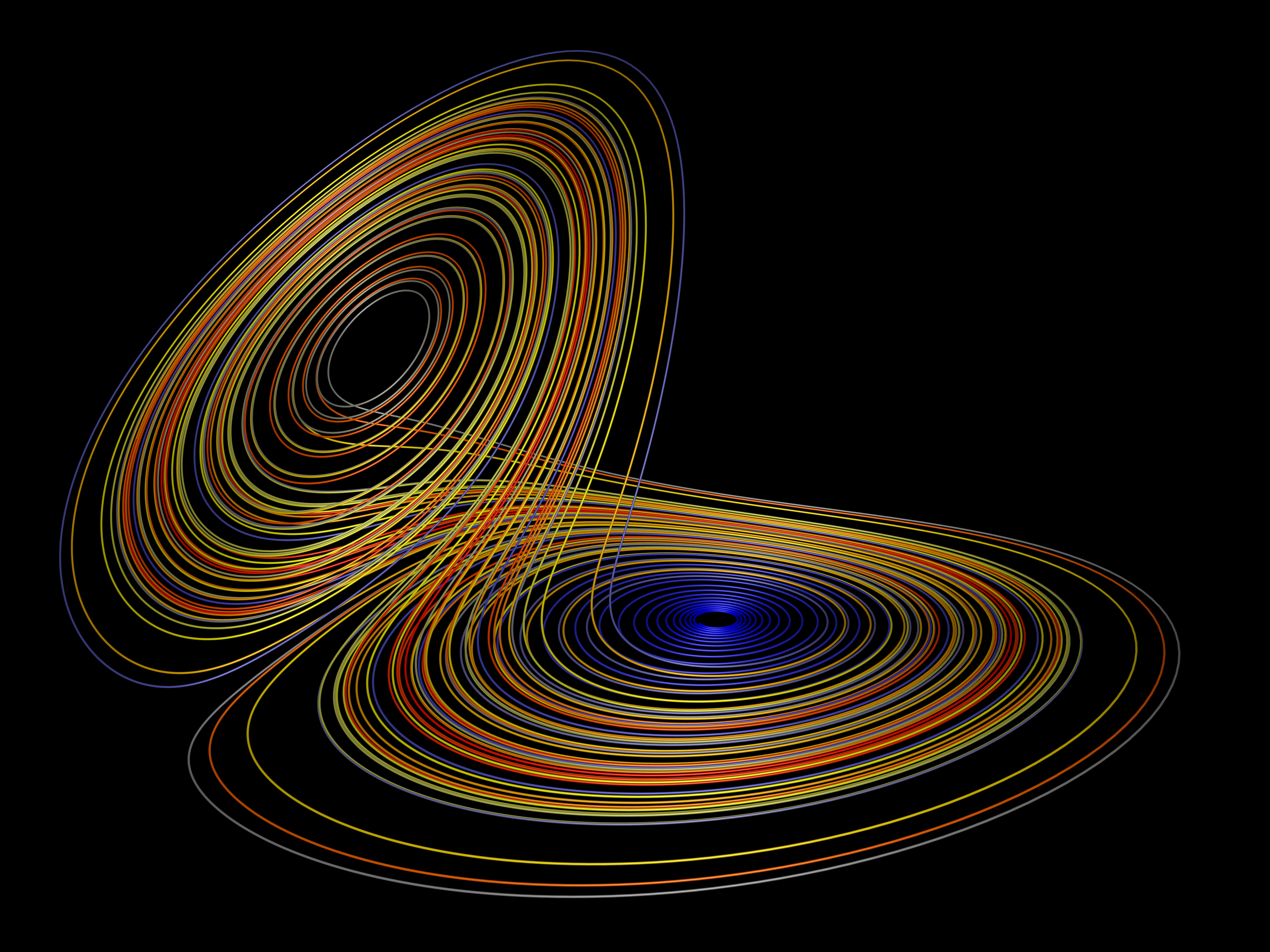

The Lorentz Attractor: Finding Order in Chaos

Now, let's talk about something called the Lorentz attractor. Picture a weird-shaped figure that looks like a butterfly's wings. This is a visual representation of chaos theory. It shows how a system evolves over time in a chaotic, but still kinda predictable, way.

In trading, the market behaves like the Lorentz attractor. It moves in a seemingly random pattern, but if you look closely, you might spot some trends or patterns emerging.

Hidden Markov Models: Hunting for Patterns

Hidden Markov models (HMMs) are like detectives hunting for clues in a mystery. They're mathematical tools that help us uncover hidden patterns in data.

In trading, HMMs analyze past market data to detect patterns that are not immediately obvious. For example, they might notice that whenever a certain event happens, like a company releasing its earnings report, the market tends to react in a specific way.

Putting it Together: Chaos Theory in Trading

So, how does chaos theory affect trading? Well, it helps traders understand that the market is not just a random mess. There's some order hidden within the chaos, like the patterns revealed by the Lorentz attractor and HMMs.

Traders use chaos theory to spot these patterns and make better predictions about future market movements. It's like trying to predict the weather. You can't control it, but with the right tools, you can make educated guesses about what might happen next.

In the end, chaos theory reminds us that even in the most unpredictable situations, there's still some order to be found. And for traders, finding that order can mean the difference between success and failure in the market.

Our Take

In the complex world of trading, understanding chaos theory and mathematical models is crucial for success. What is explained here is the tip of the iceberg when it comes to what we use. We specialize in uncovering hidden patterns and trends in market data to help traders navigate the turbulent waters of the market with some of the theoretical models based on chaos theory. The secrets to profit from chaos is a willingness to embrace entropy. So we do!